Beware of Three 'Ticking Time Bombs'

Marc Chaikin just released the name of THREE stocks he's calling 'Election Ticking Time Bombs'.

Each one of these has been flagged by the Power Gauge and could see huge losses during the election year...

Marc recommends you steer clear of them for 2024.

Ticking Time Bomb #1: FedEx (FDX)

Everyone knows FedEx (FDX). The 53-year-old company is a giant in the delivery industry.

But if you type this stock into the Power Gauge right now...

You'll see the rating is BEARISH.

In other words, now is NOT the time to invest in FedEx.

The Power Gauge makes it easy for you to see...

It analyzes 5,000-plus stocks in its universe using 20 factors in four categories (Financials, Earnings, Technicals, and Experts). Then, it spits out an actionable rating for each stock.

Today, the system says to avoid FedEx. And there are a couple of reasons why...

First, the company's Air Freight and Logistics sector is struggling. This segment got a huge boost during the COVID-19 pandemic as many folks turned to at-home shopping.

But here in early 2024, we're a long way from the pandemic. And FedEx's package volumes have now declined for more than a year.

Another problem is Amazon's (AMZN) shift from a FedEx customer to a FedEx competitor...

The e-commerce giant stopped using FedEx back in 2019. And after years of building out its own delivery business, Amazon now handles more packages than either FedEx or rival UPS (UPS).

Of course, FedEx won't go out of business anytime soon. It's still a big, profitable company. And it has trimmed expenses and hiked shipping rates in recent years to keep its profits up.

But when you factor in the effects of the coming election, FedEx's stock could be a ticking time bomb. And the Power Gauge sees what's happening beneath the surface...

FedEx currently receives a "neutral" grade in the Financials category. And it gets a "bullish" rating for Earnings. That tells us the company's financials aren't terrible.

But with the full picture, we can see the problem is in Technicals and Experts. The Power Gauge gives FedEx a "bearish" and "very bearish" grade, respectively, in those two categories.

Put simply, FedEx's price action has been extremely weak...

As we go to press, the stock has significantly underperformed the broad market over the past six months. It's down around 5% in that span. And the benchmark S&P 500 Index is up about 16%.

Plus, FedEx receives a "bearish" grade for the Chaikin Money Flow indicator today...

That tells us the so-called "smart money" has been selling their FedEx shares recently. By that, I'm talking about some of the market's biggest players – like institutional investors.

FedEx's "very bearish" rating in Experts is partially due to the extreme weakness in its industry. And Wall Street analysts have been slashing their earnings estimates for the company.

The simple fact is that nothing makes a stock go UP or DOWN faster than institutional investors. And the Power Gauge sees the selling that's slowly building behind FedEx.

It's a major warning sign that something bad could soon unfold.

That's why it's critical for investors like you to AVOID this stock at all costs.

Otherwise, you're risking massive losses.

Ticking Time Bomb #2: Take-Two Interactive (TTWO)

Here's another stock you should type into the Power Gauge to get the REAL story...

Take-Two Interactive (TTWO) is a much-loved name in the video-game industry.

The company owns the blockbuster Grand Theft Auto franchise. Over its lifetime, video-game enthusiasts have bought more than 400 million copies of the various installments.

The excitement is already building for the next game in the series, Grand Theft Auto VI. It's expected to come out in 2025. (Take-Two hasn't set an official release date yet.)

Sometimes, it makes sense to buy a stock before a major positive event. But not in this case...

You see, the Power Gauge sees trouble brewing beneath the surface at Take-Two.

It gives the stock a VERY BEARISH overall rating today. And if you dig a little deeper, you can see the problems clearly...

Take-Two gets "very bearish" grades in both Financials and Earnings. The company's return on equity is negative. And the stock doesn't look cheap (based on its high price-to-sales ratio).

Even worse, Take-Two's profits have declined for two straight years. And the company's latest earnings announcement (earlier this month) was a disaster...

Take-Two told Wall Street that next quarter's sales will be roughly $200 million less than analysts expected. The news sent the stock plunging nearly 9% in a single day.

That's not the only problem the Power Gauge helps us uncover...

In the Technicals category, Take-Two gets another "very bearish" grade due to massive weakness in price and volume trends. And the Chaikin Money Flow indicator is "very bearish" as well. In other words, the so-called "smart money" is running for the exits.

Keep in mind, these types of institutional investors matter the most in the stock market...

Big asset managers and hedge funds are behind almost every big stock move in history. When they're buying, it's often a signal of much bigger gains ahead. And when they're selling, look out below.

In Take-Two's case, the Power Gauge sees more downside ahead. Company insiders have reduced their positions over the past year. Plus, Wall Street analysts have slashed their estimates for future earnings.

The Power Gauge is giving us a clear message on Take-Two...

Stay away.

This is a perfect example of why the Power Gauge is such a powerful tool. It sees multiple red flags that could turn Take-Two into a ticking time bomb in 2024.

Don't get caught in this trap right now.

Ticking Time Bomb #3: Becton Dickinson (BDX)

Our last potential "ticking time bomb" is a dominant player in the health care space...

You might not recognize its name. But you've likely used some of its products.

Becton Dickinson (BDX) sells roughly 50,000 different medical devices, instruments, and reagents. It makes everything from syringes to nasal-spray systems to urine meters.

It's a surprisingly huge company, too. In fact, Becton Dickinson's $70 billion market cap makes it bigger than other well-known businesses like PayPal (PYPL), Capital One Financial (COF), Ford Motor (F), and 3M (MMM).

But if you type "BDX" into the Power Gauge, you'll see the company is in trouble...

The Power Gauge gives Becton Dickinson a BEARISH overall rating today.

Put simply, the company isn't growing at an impressive clip. Over the past two years, its sales have grown an average of less than 1% annually.

Even worse, Becton Dickinson's profits are falling. Its net income declined nearly 30% from 2021 to 2023.

That's not something investors ever want to see. And the Power Gauge makes it easy for us to get that data.

Not surprisingly, the Financials category is a major weak spot. The Power Gauge points to the company's weak free cash flow and low return on equity as major red flags.

The Earnings category reveals more issues for Becton Dickinson...

The company's long-term results have been solid. But its earnings trend recently turned negative. That switch could indicate the start of a new downtrend.

The Power Gauge also gives Becton Dickinson a "very bearish" grade in Technicals...

As we go to press, the stock is down more than 10% over the past six months. Meanwhile, the S&P 500 is up roughly 15% in that span.

Moving on, the Chaikin Money Flow indicator for Becton Dickinson is firmly in the red zone. That means the so-called "smart money" has been dumping shares in recent months.

If Becton Dickinson was a bargain after its recent decline, institutional investors would be buying the stock. Instead, they're still heading for the exits. That's not a good sign.

Sometimes, it's hard to tell why these big asset managers are selling. But ultimately, we don't need to know the exact reasons. The Power Gauge answers the only question that matters...

Are they BUYING or SELLING?

In Becton Dickinson's case, the answer is clear...

This stock is a ticking time bomb that could blow up your portfolio in 2024.

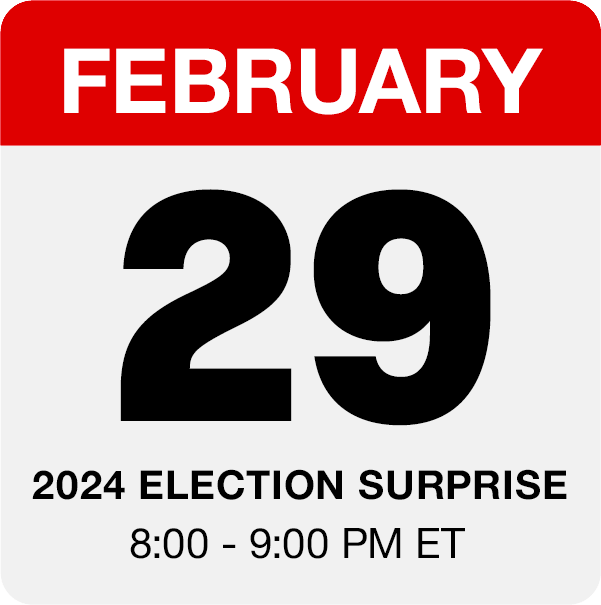

Don't miss The 2024 Election Surprise, which goes live in:

Save the Date

Be sure that you don't miss this groundbreaking event! Go ahead and add an event reminder to your calendar by clicking here. (This will automatically add an appointment to your computer calendar).